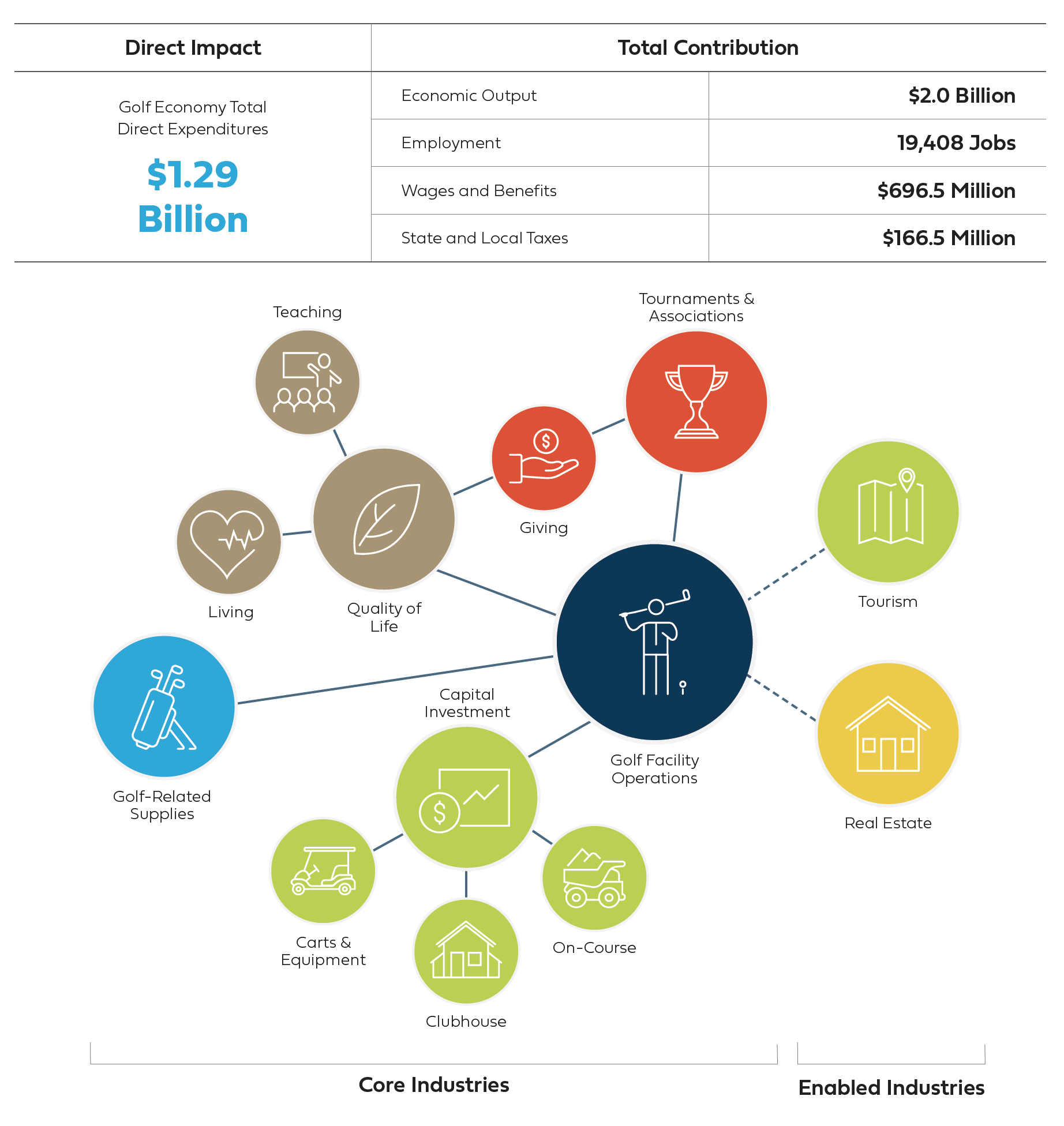

Economic Summary

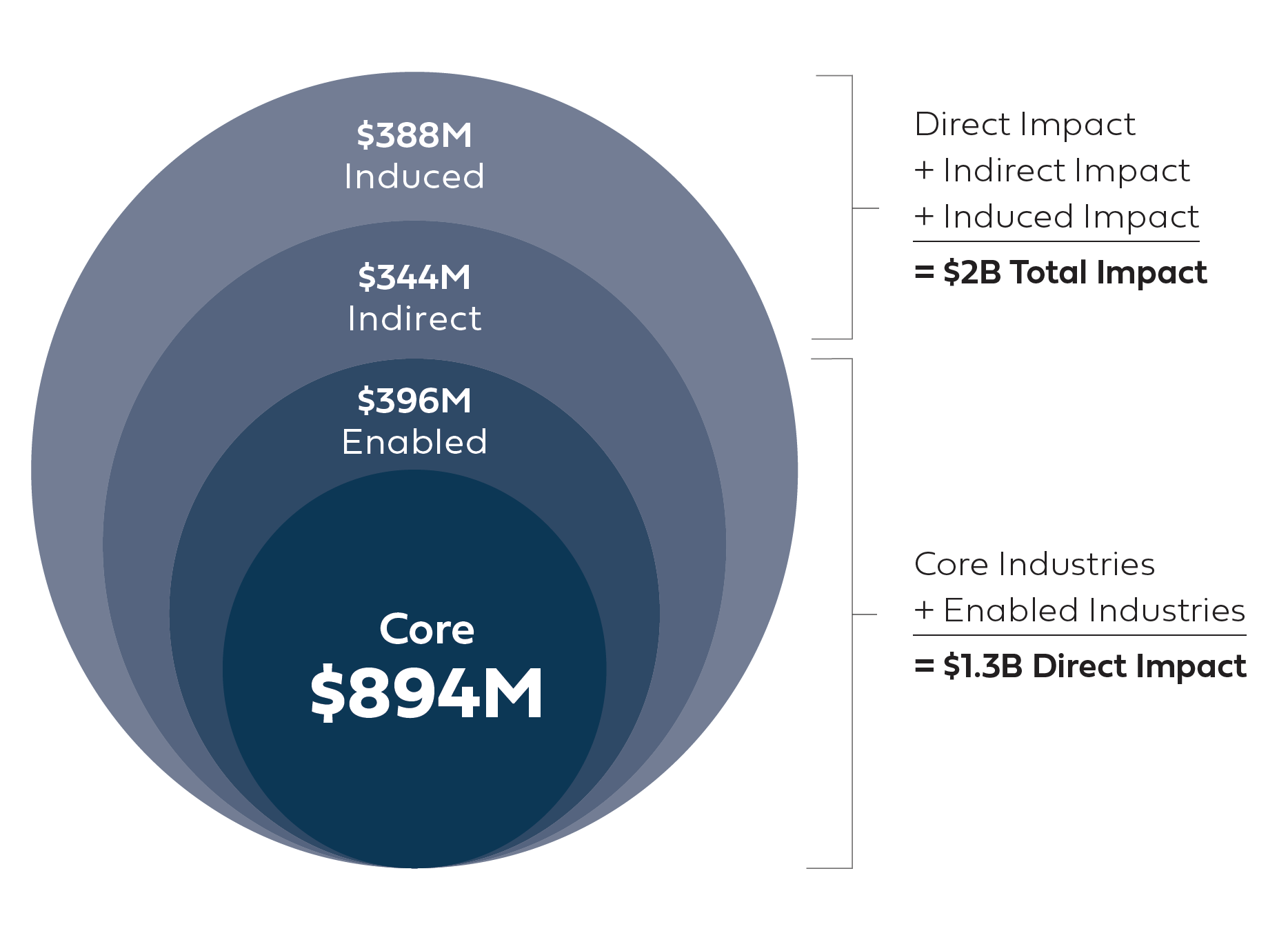

In 2019, the size of Colorado’s direct golf economy was approximately $1.29 billion, while the industry is estimated to have generated just over $2.0 billion (direct, indirect, and induced) to the wider Colorado economy in 2019, which compares favorably to the $4.8 billion and 46,113 jobs contributed by the snow sports industry in the state in 2015[1]. Golf supports just over 19,400 jobs with $696.5 million of wage income and more than $166.5 million in state and local taxes.

Core Industries

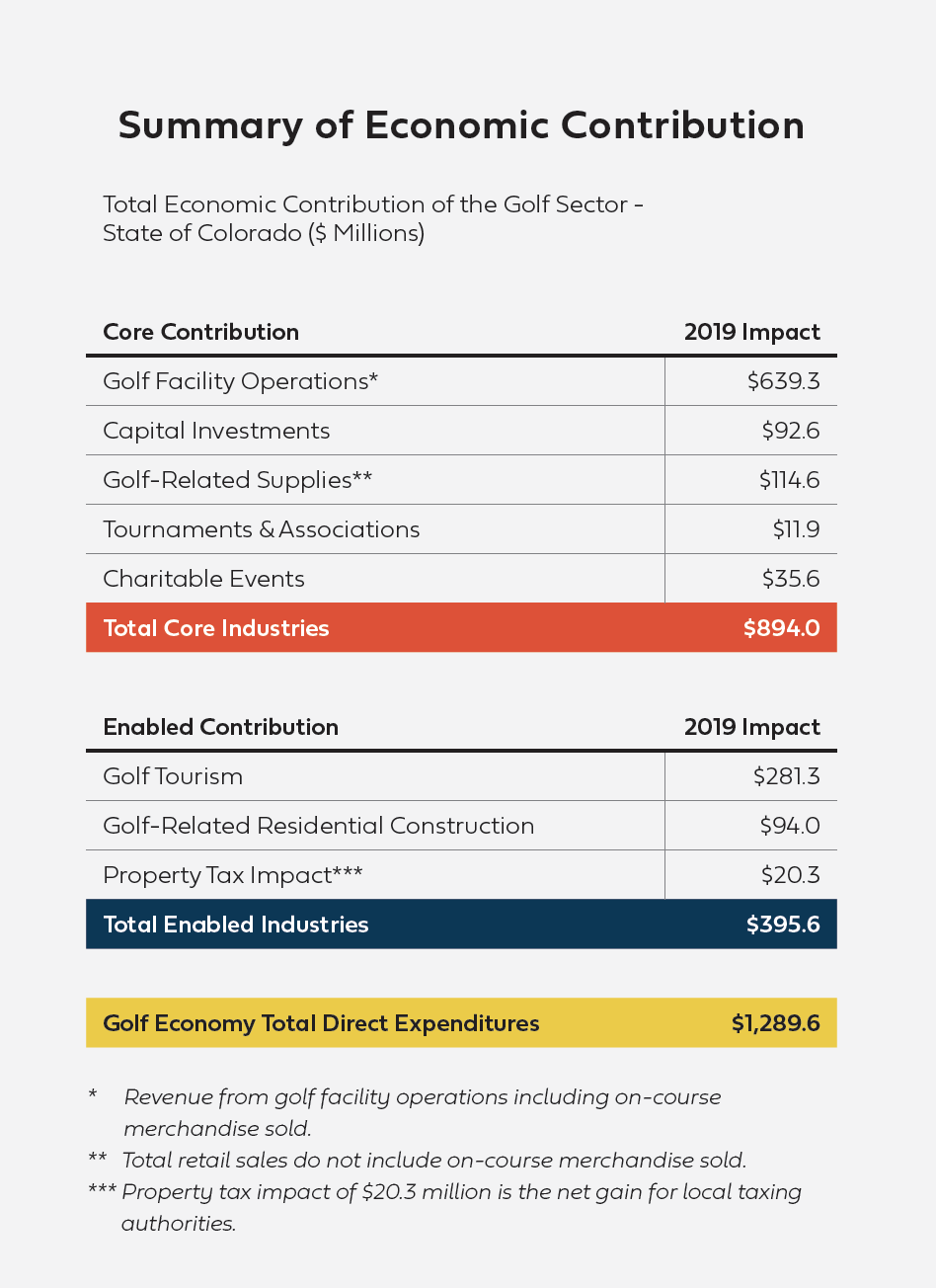

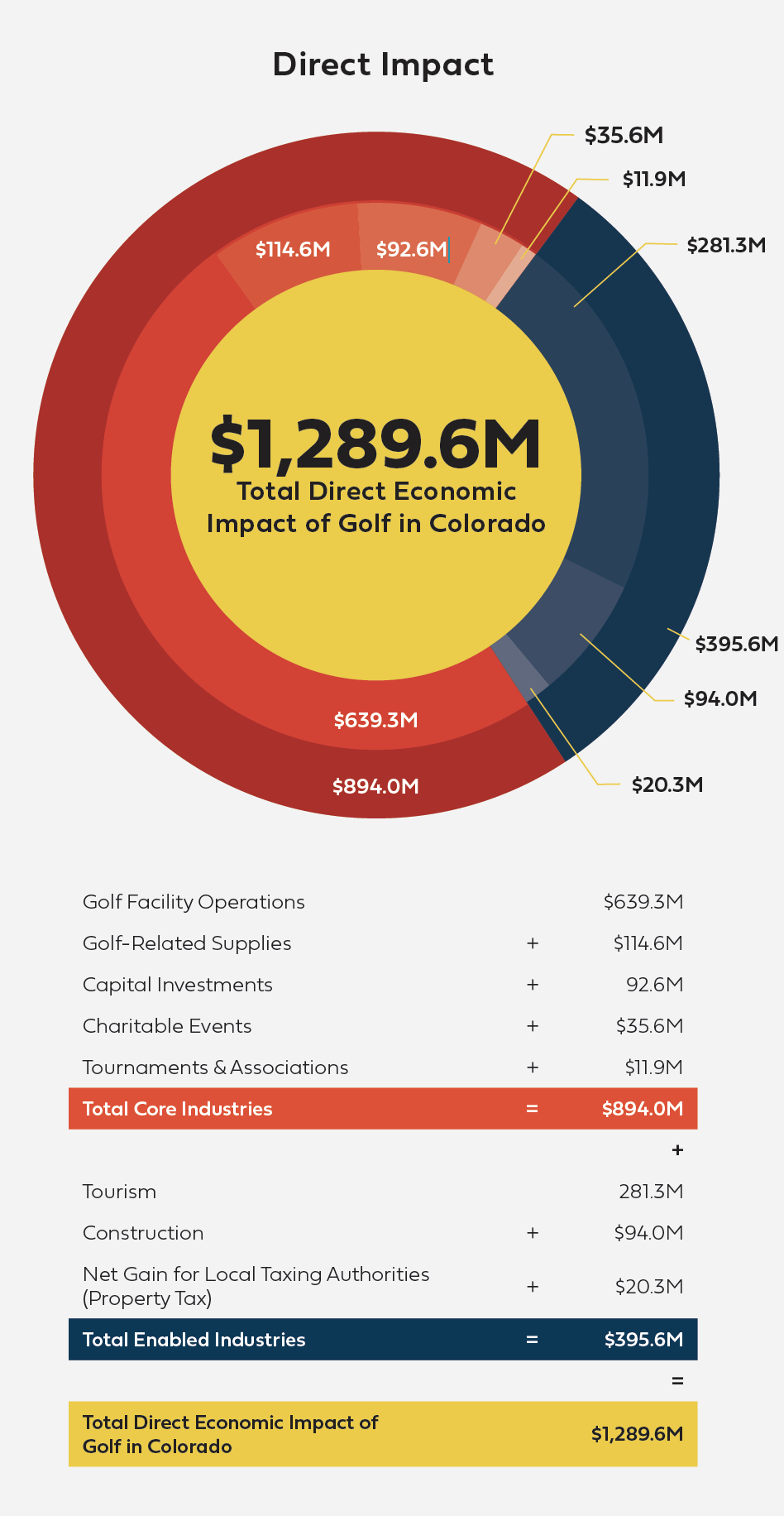

Summary of the direct economic impact of golf on the state of Colorado:

Colorado retailers earned a $56.0 million margin on $128.38 million of gross retail sales of golf clothing, equipment, and shoes in 2019. Of this retail volume, $70.48 million came from off-course retail outlets (including online) supporting 1,200 jobs. The remaining $58.0 million came from on-course pro shops (included in total golf spending noted above).

Colorado is also home to about 80 other companies that provide golf products and services, including several major golf architects, consultants and turf companies. GOLFTEC, a national swing mechanics and golf equipment retailer has its headquarters in Englewood. The total gross revenues from these golf companies totaled $44.2 million in 2019 and supported at least 600 jobs in the state.

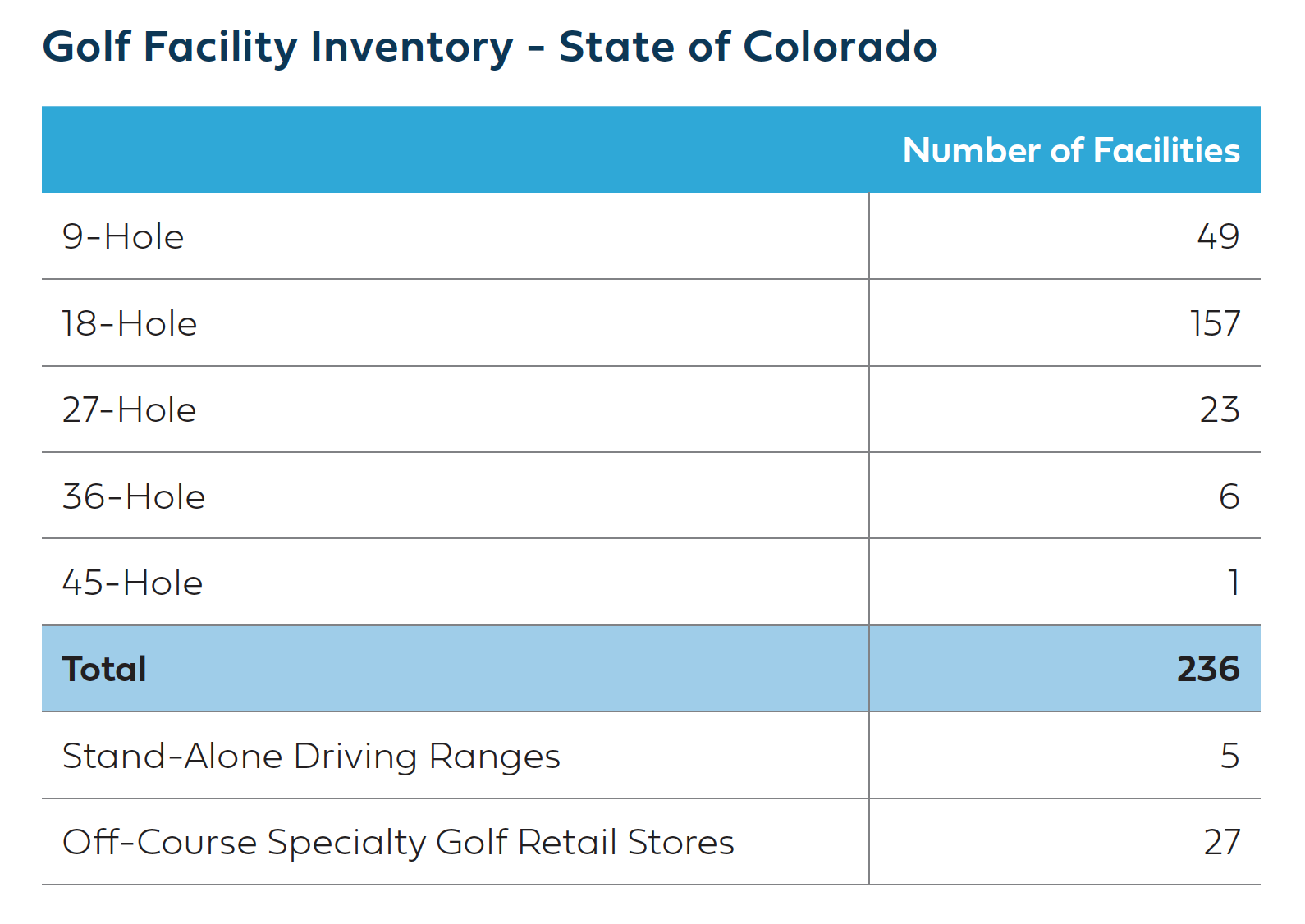

The state has 236 golf facilities (179 public and 57 private), including a high proportion of government-owned (municipal) golf facilities, representing 46% of public courses in the state (compared to 23% in the US). There are 90 golf facilities connected to residential real estate and/or resorts.

Total consumer spending at golf facilities for items including initiation fees, member/passholder dues, green fees, cart fees, golf shop merchandise and food/beverage sales, exceeded $639.3 million in 2019, compared to $560 million in 2002 (14.2% increase). Golf facility operations supported over 14,700 jobs (both part-time and full-time), compared to 10,913 jobs estimated in 2002.

In 2019, Colorado golf facilities invested more than $92 million in capital improvements for new facilities, golf course renovations/enhancements and improving or replacing structures, supporting close to 1,100 additional jobs. In all, 35.7% of all Colorado golf facilities began or continued large-scale capital projects in 2019 that were not included in regular operating expenses.

While Colorado did not host a PGA Tour event in 2019, the state has hosted the PGA Tour’s BMW Championship as recently as 2014 and will host this event again in the 2020s (date yet to be determined). This tournament is one of the tour's three FedEx Cup Playoff events and generated over $33.9 million in economic impact when it was held in Illinois in 2019. Colorado was also host to the USGA’s US Senior Open at The Broadmoor in 2018 and generated over $10.0 million in economic impact. The only significant professional golf event in Colorado in 2019 was the first annual Korn Ferry Tour event, the TPC Colorado Championship at Heron Lakes, with an estimated economic impact of $6.5 million. There were additional pro events held in 2019 which attracted visitors and created additional economic impact. Combined, associations and tournaments support 150 jobs in the state.

Enabled Industries

Other golf-related economic impacts include:

NGF research indicates that about 529,000 overnight trips were made to Colorado in 2019 by visitors seeking to participate in golf, plus an additional 664,000 trips of more than 50 miles made within the state during the year. These visiting golfers are estimated to have contributed $281.3 million to the Colorado economy and added 1,650 jobs from induced and indirect activity such as transportation, lodging, meals and other entertainment.

The presence of golf courses located within, or in immediate proximity to, residential communities adds value to real estate in Colorado. The economic impact of golf real estate in Colorado encompasses two components: (1) Golf-related residential construction; and (2) Net gain to local tax jurisdictions from value premiums associated with golf course real estate:

There are six (6) separate golf communities identified in Colorado that had residential units under development in 2019, yielding a total estimated 2019 golf-related residential construction figure of $94 million.

The presence of a golf course with direct frontage on, or in immediate proximity to, a residential unit will provide an added value to the residential property known as the “golf premium.” It is estimated the “golf premium” associated with these developments to be upwards of $2.2 billion, with a 2019 property tax impact of $20.3 million in net gain for local taxing authorities to be used for education and other local initiatives funded by property tax revenue.

Non-Economic Contribution Highlights

In addition to the above, other impacts that golf has on the state of Colorado, include:

Golf provides affordable outdoor recreation to tens of thousands of Coloradans. Nearly all (96%) of Colorado golf facilities offered a junior golf program, while upwards of two-thirds of golf facilities offered specialized programs for minorities, first-responders, and military veterans.

Colorado has the second highest percentage of Audubon Cooperative Sanctuary Program-certified golf facilities (19%) in the US, and the 4th highest total of Program-certified golf facilities (45). The rate of Audubon Cooperative Sanctuary Program-certified golf courses is twice as high in Colorado as it is among all other states in the Mountain region (10%).

Colorado has hosted several major championships, each with significant economic impact. Colorado hosted the U.S. Senior Open as recently as 2018 (also 2008) and the U.S. Women’s Open in 2011 (both at Broadmoor in Colorado Springs). The state hosted the U.S. Open in 1960 and 1978, and the PGA Championship in 1967 and 1985. The appeal of the state and top venues like the Broadmoor make it likely that these major events can and will return to Colorado.

Overall Impact Summary

Golf in Colorado has impact well beyond its numbers and in higher proportion than the state’s population would suggest. While Colorado ranks 21st in population among the states, it ranks 18th in golf participation and 9th in golfer-to-golf-facility ratio.

While past data is not a certain indicator of what golf could be in Colorado, the $2.0 billion in direct, indirect, and induced contribution in 2019 suggests that the economic impact of golf in Colorado continues to improve, and the 19,400 jobs are expected to increase in years to come.

The Colorado Golf Market

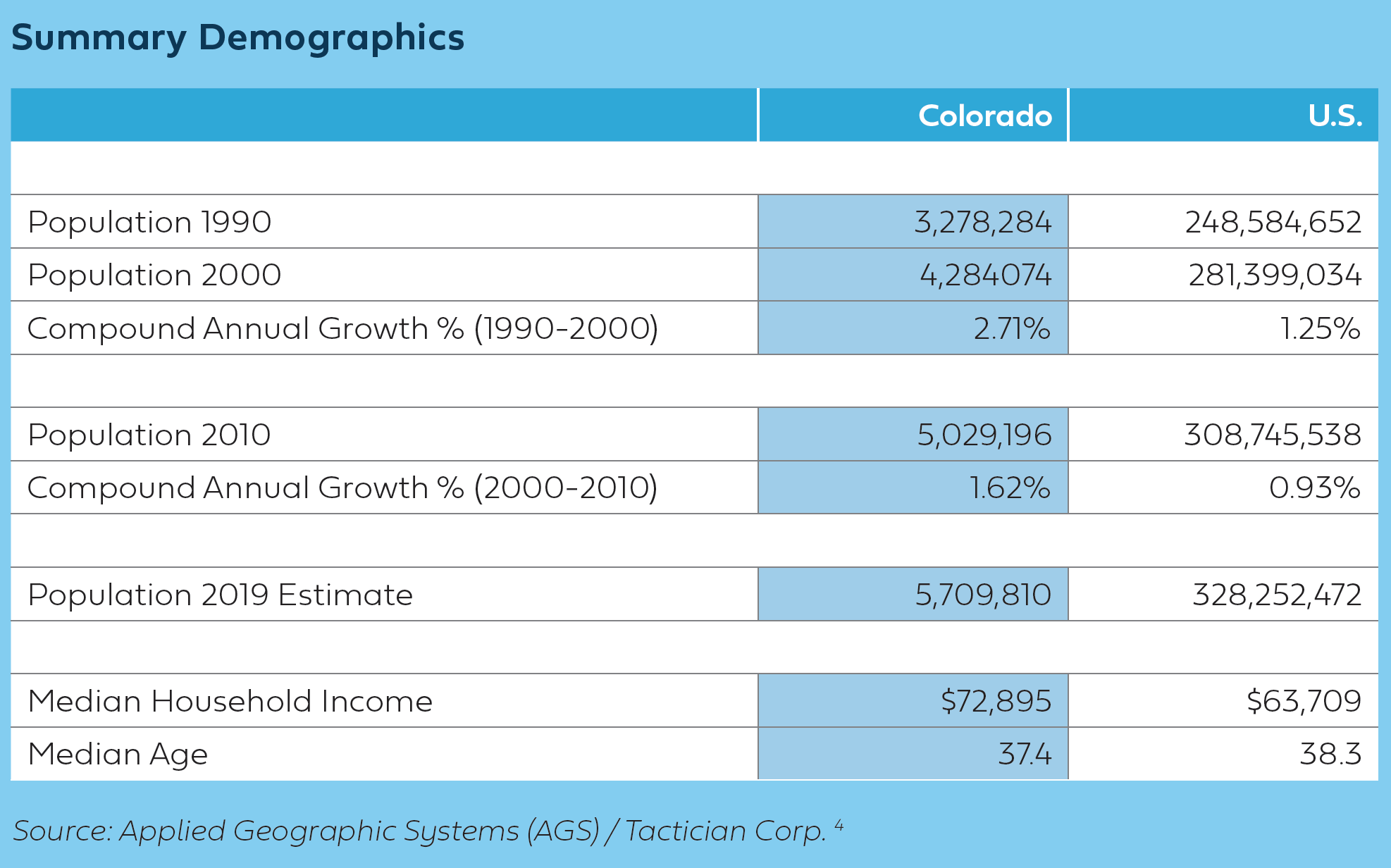

Colorado covers a land area of 104,094 square miles and is home to an estimated population of 5.76 million people in 2019[2]. The largest city and metro area in the state is Denver (also the state capital), with more than 2.9 million residents[3].

The climate of Colorado is more complex than states outside of the Mountain region. Unlike other states, southern Colorado is not always warmer than northern Colorado. Most of Colorado is made up of mountains, foothills, high plains, desert lands, and mountains with surrounding valleys that greatly affect local climate. Colorado is generally a seasonal golf market, with a large portion of golf facilities closing entirely for the winter.

Economic Highlights

The economy of Colorado has broadened from its historic roots of mining, irrigated agriculture, and raising livestock. Early industry was based on the extraction and processing of minerals and agricultural products. Current agricultural products are cattle, wheat, marijuana, dairy products, corn, and hay. In the last 70 years, there has been expansion in the industrial and service sectors and Colorado is known for its concentration of scientific research and high-technology industries; in addition to Denver as an important financial center. Other industries include food processing, transportation equipment, machinery, chemical products, minerals such as gold and molybdenum, and tourism. Colorado has the largest annual production of beer of any state.

The federal government is a major economic force in the state with many important federal facilities including NORAD (North American Aerospace Defense Command), United States Air Force Academy, and several other military bases. In addition to these and other federal agencies, Colorado has abundant National Forest land and four National Parks that contribute to federal ownership of 24,615,788 acres of land in Colorado, or 37 percent of the total area of the state.

Golf in The State of Colorado

Golf in Colorado is very “Midwestern” in nature. That is, the golf facility industry is heavily oriented toward affordable public access golf, and the public access golf is disproportionately municipal, compared to the overall U.S. The two largest cities in the Metro Denver area (Denver and Aurora) operate 12 municipal golf courses that are especially popular, located in proximity to other park activities and support services. In recent years, golf has also become increasingly tied to residential real estate developments in and around the major metro centers of the state, with new golf facility development in the state driven mostly by new residential communities.

Colorado Golf Market

Of Colorado’s 236 golf facilities, 76% are public, compared to 74% nationally. Of the state’s public facilities, 46% are municipal, as opposed to 23% nationally.

Colorado’s public access golf courses are generally quite affordable. 87 of the state’s 179 public golf facilities – 49% – have been classified as “Standard” facilities, meaning peak season weekend green fees with cart are between $40 and $70. The remaining 92 facilities are split evenly between “Value” (under $40) and “Premium” (over $70).

There are 24 resort golf facilities with significant lodging components. In addition to golf, these resorts generally feature amenities such as snow sports activities (in winter) and other mountain and nature-oriented activities.

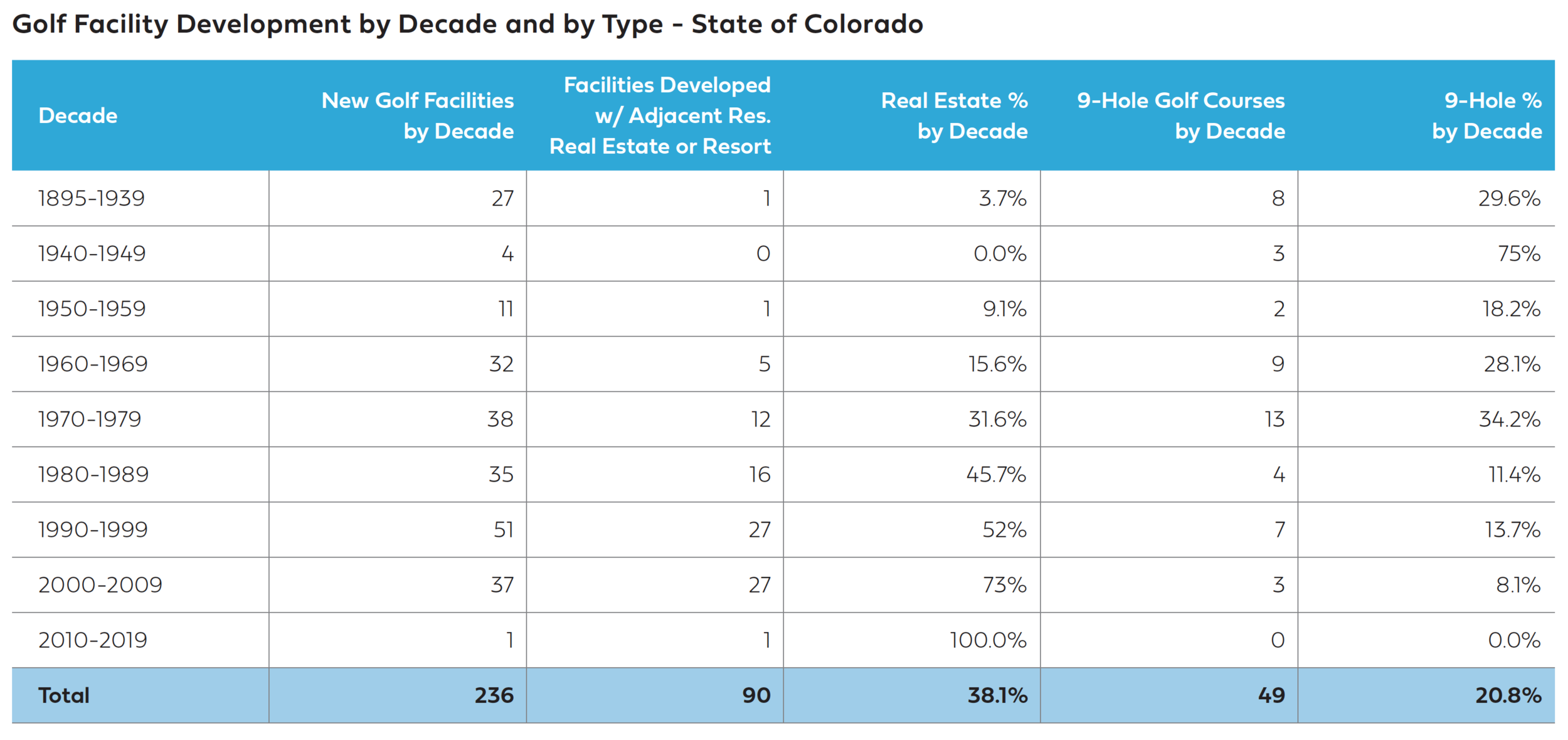

Much of the new golf course development in Colorado over the past two decades has been associated with new real estate development. Between 1990 and 2009, 61.4% of new golf facilities were part of real estate developments.

In 2019, there were 179 public golf facilities and 57 private golf clubs in operation in Colorado, for a total of 236 facilities. In addition, there were five stand-alone driving ranges in the state, including two Topgolf facilities. New golf course construction has been vigorous in Colorado, with 88 golf facilities (37 percent of the total golf facility inventory in the state) built after 1990, compared to 26 percent for the total U.S.

Colorado Golf Industry Economic Impact Alignment to SDGs