Golf Facility Operations

In Colorado and elsewhere, the golf facility is at the core of the overall golf economy. The golf facility economy includes all revenues generated from green fees, cart fees, membership fees and initiation fees, as well as ancillary golf course purchases such as merchandise, food and beverage, banquets and other revenue. The revenue collected from all of these sources is assumed to be the basis for all expenditures required to operate the facility.

Finding

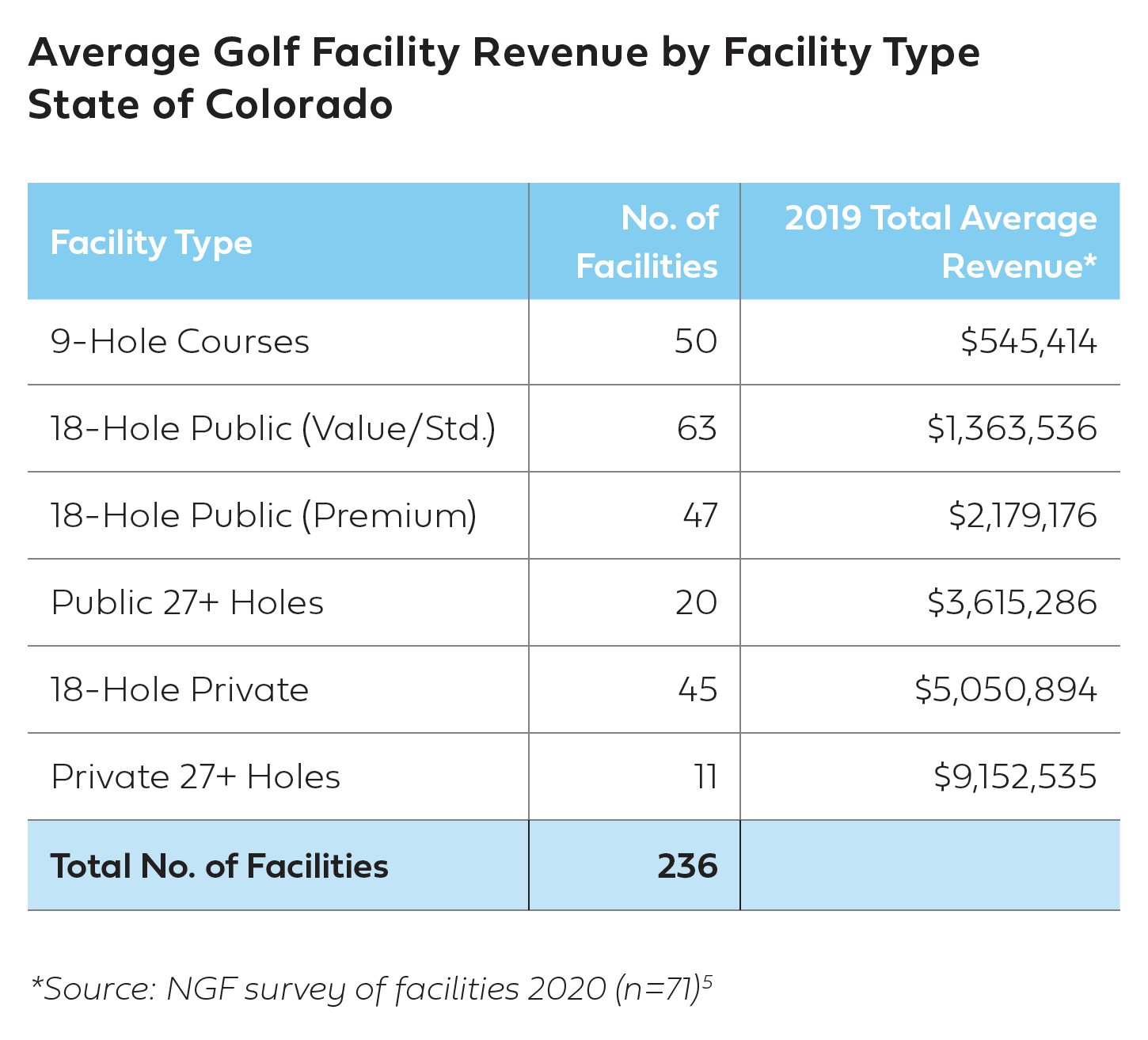

Direct research into the actual performance at Colorado golf facilities in 2020 shows average revenue in 2019 by type of facility as follows:

In addition, Colorado also has five (5) stand-alone driving range facilities, including two Topgolf locations in Centennial and Thornton (opened in 2019). Separate NGF research provided an estimate of $10 million in total revenue from Topgolf facilities in 2019. The remaining stand-alone ranges are generally smaller (under 40 stations) and average $50,000 in revenue per location.

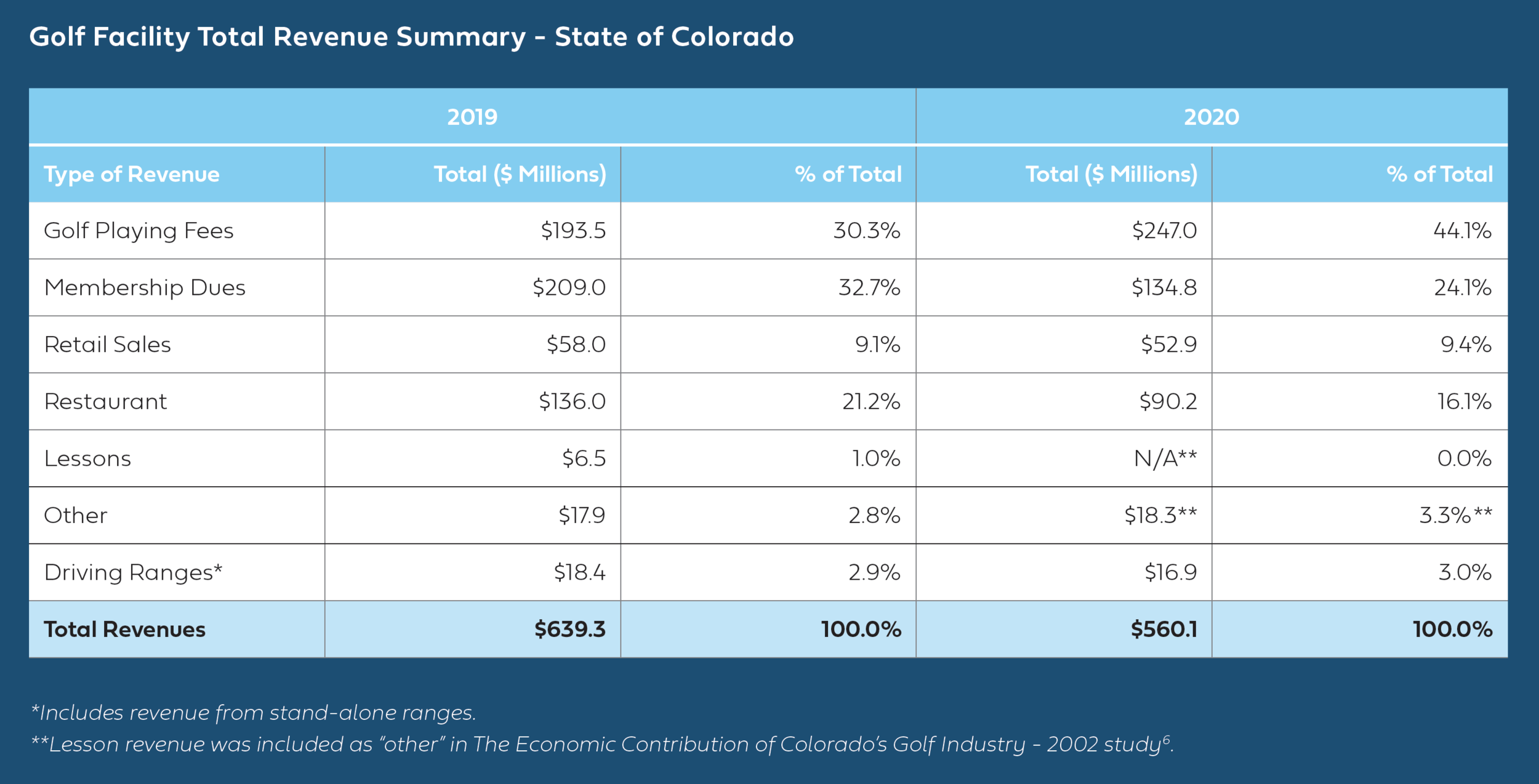

Colorado’s 236 golf facilities generated $639.3 million in operating revenue in 2019, up from $560.1 on 223 facilities when it was last measured in 2002. The analysis of total golf facility revenues is divided into six segments – golf playing fees (green, cart fees), membership dues, retail sales, restaurant, lessons, other and driving ranges (includes stand-alone ranges).

The golf courses in Colorado hosted a total of 6.49 million rounds of golf, or approximately 28,086 rounds per 18 holes. This volume of golf activity is relatively strong for Colorado given the state’s climate and relatively short golf season. The total U.S. averages 31,529 rounds per 18 holes in 2019 across all climates.

The average revenue from green, cart and membership fees in the state was $62.05 per round of golf, plus additional revenue from ancillary items such as driving range ($3.61), total F&B + banquets ($20.19), pro shop merchandise ($8.94) and other items ($3.75).

Approach

What is measured

Golf Facility revenue includes all receipts generated from green fees, cart fees, membership fees and initiation fees, as well as ancillary purchases at the golf course facility such as merchandise, food and beverage, banquets and other items. The revenue collected from all of these sources is assumed to be the basis for all expenditures required to operate the facility.

How it’s measured

Golf facility revenue data comes from the 2020 Colorado golf facility survey conducted by NGF, which collected data on reported revenues by type for each of the six classes of golf facilities (n=71). The revenues generated from driving ranges was applied to only those golf facilities that had a driving range on site (208 of the 236 facilities), plus additional revenue assumed for five stand-alone ranges in the state. It is noted that two of the stand-alone ranges are Topgolf facilities, assumed to have total revenue of $10 million in 2019 (50% in F&B).

[5] National Golf Foundation. Survey of Colorado Facilities. 2020

[6] Steve Davies*, Phil Watson, Amanda Cramer and Dawn Thilmany, Ned Prosser and E. Peter Elzi, Jr. The Economic Contribution of Colorado’s Golf Industry. June 2004.